Subhadra Yojana: Odisha's Move for Women & Digital Growth

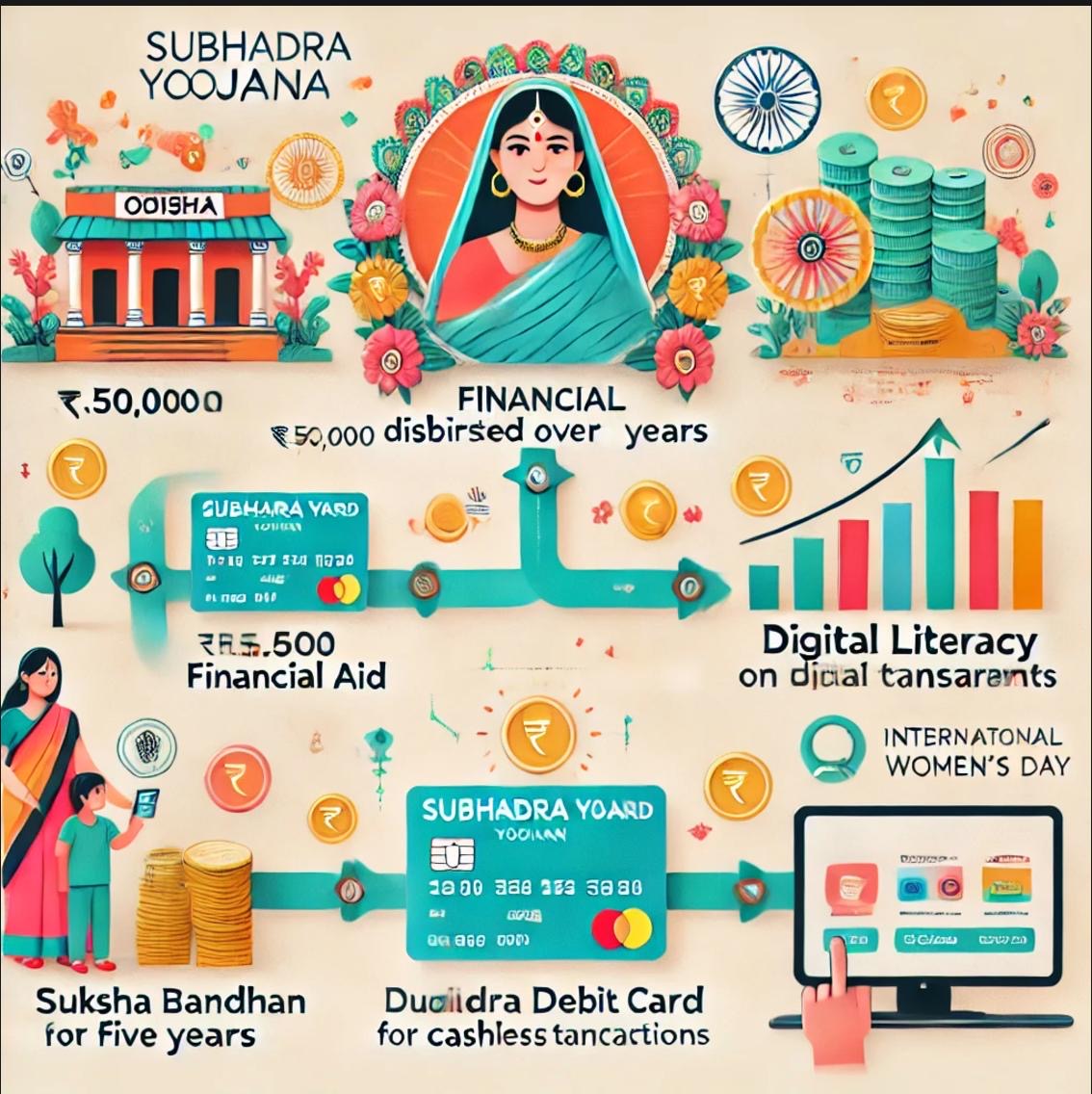

The Subhadra Yojana, introduced by the Odisha government in September 2024, is a transformative welfare initiative designed to empower over one crore women from economically weaker sections.

With a unique blend of financial support, digital literacy, and cultural sensitivity, this scheme not only uplifts women but also strengthens their role as decision-makers in families and communities.

At a time when women empowerment in India remains a critical goal, Subhadra Yojana is a shining example of how state governments can address systemic barriers to gender equality.

Why Subhadra Yojana Matters

India has made strides in women empowerment, but for rural women, barriers like financial dependence, lack of digital skills, and cultural stereotypes persist. Subhadra Yojana tackles these challenges head-on, offering holistic support to ensure economic independence and digital financial literacy, two cornerstones of modern empowerment.

The scheme’s thoughtful design ensures that it’s not just another welfare program but a catalyst for change, impacting families and communities across Odisha.

Key Features of Subhadra Yojana

- Financial Assistance with Cultural Relevance

- Eligible women receive ₹50,000 over five years through Direct Benefit Transfer (DBT), disbursed in biannual instalments of ₹5,000. These installments coincide with Raksha Bandhan and International Women’s Day, adding a cultural resonance that makes the initiative more meaningful for the beneficiaries.

- 👉 Why this matters: The consistent financial support helps women plan better, covering essential needs like education, healthcare, or entrepreneurial ventures.

- Promoting Digital Financial Literacy

- Each beneficiary receives a Subhadra Debit Card, encouraging them to engage in cashless transactions. Additional incentives, like a ₹500 bonus for the top digital users in every locality, motivate rural women to embrace banking technologies.

- 👉 Why this matters: By making digital financial tools accessible, the scheme helps women transition from traditional cash-based systems to modern banking, empowering them to participate in the digital economy.

- Targeted and Inclusive Eligibility

- The scheme focuses on women aged 21 to 60 years from economically weaker households, excluding government employees and income taxpayers. This ensures that the benefits reach those who need them most.

- 👉 Why this matters: A clear and inclusive eligibility framework avoids dilution of resources, maximizing impact on the most deserving groups.

Subhadra Yojana: Empowering Women in Odisha

This scheme is not just about financial assistance—it’s a tool for transformational change in how women perceive themselves and their role in society.

1. Financial Inclusion and Economic Upliftment

Direct cash transfers through DBT encourage women to use bank accounts, an essential step toward financial independence. This has ripple effects on household welfare, including better education for children, improved healthcare, and increased savings.

2. Fostering Digital Financial Independence

With over 80% of rural women previously unbanked, Subhadra Yojana bridges the gap by introducing cashless transactions and digital banking. This aligns with the Digital India Mission, ensuring women are not left behind in the country’s digital transformation.

3. Nurturing Entrepreneurs and Breaking Stereotypes

The scheme encourages women to invest in small businesses or skill development. By putting financial resources directly in their hands, it shifts the narrative around financial decision-making, traditionally seen as a male domain.

Example: Women like Radha in Ganjam, who started a tailoring business with Subhadra funds, are paving the way for local entrepreneurship and job creation.

Real Stories of Impact

- Padmini’s Path to Education

- Padmini, a widow from Keonjhar, used the annual ₹10,000 to cover her children’s school fees and buy books. For the first time, she feels hopeful about securing their future.

- Sarita’s Digital Transformation

- Sarita from Bhubaneswar became a top digital transactor in her locality, earning an extra ₹500. More importantly, she inspired other women in her neighborhood to embrace digital payments.

- Radha’s Entrepreneurial Journey

- Radha, a homemaker in Ganjam, withdrew funds using her Subhadra Debit Card to start a tailoring business. Today, her thriving venture employs two other women, creating a ripple effect of empowerment.

Application Process for Subhadra Yojana

Applying for Subhadra Yojana is straightforward and accessible:

- Offline: Visit the nearest Mo Seva Kendra or Anganwadi Center.

- Online: Apply via the official Odisha government website.

- Complete e-KYC with an Aadhaar-linked bank account.

- Submit required documents like proof of residence and income.

The Odisha government has ensured that even women in the most remote areas can access this scheme with minimal hurdles.

Complementing Odisha’s Women-Centric Policies

Subhadra Yojana is part of a broader vision to uplift women in Odisha. Complementary programs like Mission Shakti, which empowers women-led self-help groups, and schemes promoting girl child education reinforce the state’s commitment to gender equality. Together, these initiatives create a comprehensive framework for women empowerment.

Conclusion: A Model for Women Empowerment in India

The Subhadra Yojana is more than just financial aid—it’s a bold vision for a more equitable and inclusive society. By addressing systemic barriers like financial dependence and digital illiteracy, it empowers women to lead change in their families and communities.

This initiative is a shining example of how state-level programs can drive economic empowerment, social transformation, and digital inclusion.

Let’s spread the word! Share this article to ensure more women can benefit from this life-changing scheme. Together, we can support women-led change and inspire similar initiatives across India.

Comments

Post a Comment